What finance marketers are getting right in 2025

Lately, we’ve been sensing something in the air — and no, it’s not just the smell of baguettes from the stand on Elizabeth Street. From the briefs coming through the door to the billboards going up around town, there’s a quiet but growing confidence returning to finance marketing.

It’s a shift away from playing it safe, and toward messaging that actually connects.

In the shadow of inflation, global uncertainty and rising cost-of-living pressures, many brands treaded water or retreated to safe ground last year. They focused on building trust through stability, showcasing credentials and claims of expertise. The goal was reassurance.

The outcome? Sameness. A sea of logos telling Australians they were “here to help” without showing how.

Fast-forward to 2025, and something’s shifted.

The elephant in the room

If brands are offering us a hug, it’s because we all kind of need one.

In times of conflict or uncertainty, brand personalities tend to recalibrate. Assertive and performance-driven tones soften, and purpose and empathy rise.

Brands that connect through shared values, emotional storytelling and a sense of calm are building stronger trust and loyalty. Because right now, consumers want reassurance, not bravado.

We’re seeing:

A shift away from hard-sell, hype or humour that feels out of step.

Messaging that focuses on resilience, relevance and emotional intelligence.

Brands acting less like experts and more like people.

The feel-good factor

Finance campaigns are standing out this year with stronger emotion and a clearer, more confident tone. From cultural icons to self-doubt and fairness, brands are meeting Australians in the messy middle of their lived experience.

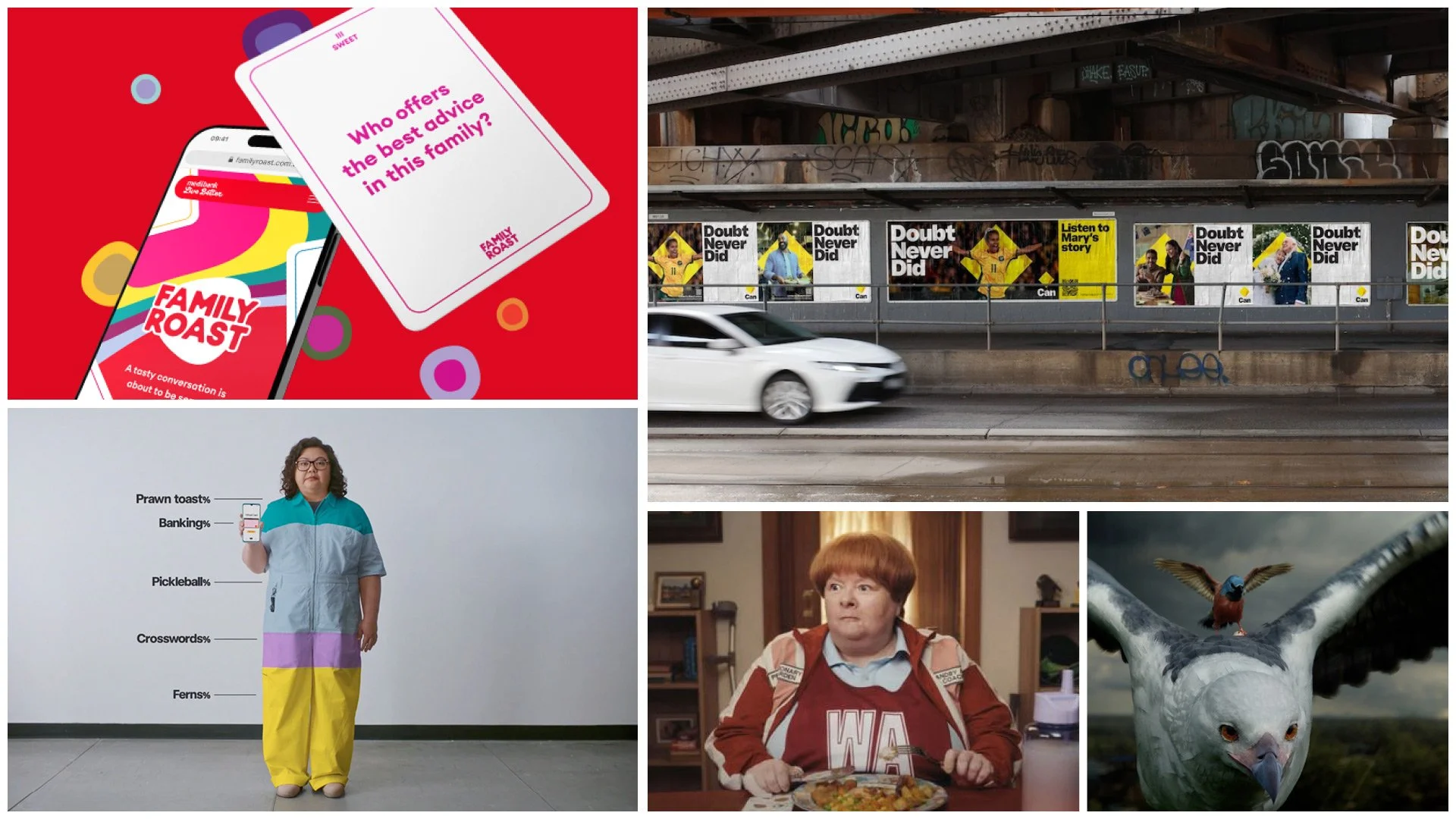

CBA’s “Doubt Never Did” reframes the bank’s role as a quiet supporter of courage and resilience. It’s focused on human stories, not product features.

Medibank’s "Family Roast” featuring Aussie icon Sharon Strzelecki leans into comedy and nostalgia to explore the emotional reality of mental health and connection through conversation.

Bankwest’s “Just enough bank” OOH campaign keeps things cheeky, weird and minimal, using clear space and self-awareness to stand out in a category prone to over-explaining.

Allianz’s new positioning centres empathy and care. It resonates with people who are eager for brands to meet their emotional needs. Yes, it’s very earnest. But pass us a tissue?

Closer to home

We’re also seeing a shift in the projects our clients are prioritising with their brand and marketing budgets this year. Here’s what we’re noticing:

More web projects are becoming more user-led. Brands are prioritising what audiences actually want to know, including prospective employees. That’s leading to clearer navigation and better content structure with intentional messaging.

Design systems and templates are getting used and appreciated. More clients are asking for brand guidelines that are both beautiful and usable. In some cases, teams are now running campaigns in-house using the tools we’ve created, which reflects a deeper investment in capability building.

Brands are getting more curious about their customers. There’s a real appetite for investment in discovery research and CX tools like personas, journey maps and playbooks. But clients want these to be practical, not theoretical. Even better, CX and brand teams are working more closely together and aligning on messaging, tone and moments that matter.

Accessibility is being treated as essential. It’s no longer an afterthought. Accessibility is being considered in everything from content and design to how success is measured. This is inclusive design with intent, not just compliance.

Reports and regulatory content are getting smarter. Clients are investing in simplifying and visualising content, especially for member and investor communications. It’s all about building trust through clarity, which we love to see.

So what does it all mean?

Brands are tuning into culture again. The circumstances that brought us here might not be ideal, but the result is a wave of work that is braver and more connected.

We’re seeing teams building the right foundations, backing ideas with heart, and finally give customers credit for having, well, feelings.

And that’s something worth leaning into.

And hey, we even got through this whole blog without saying “unprecedented times.” So proud of us.